Anti Hybrid Rules New Zealand . view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. Note that dual residence can arise very easily and can be. the guidance now requires new zealand taxpayers that are subject to the hybrid rules but ultimately have no denial of. the hybrid rules before deducting any expenditure you have incurred. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be.

from www.slideserve.com

the hybrid rules before deducting any expenditure you have incurred. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. Note that dual residence can arise very easily and can be. the guidance now requires new zealand taxpayers that are subject to the hybrid rules but ultimately have no denial of.

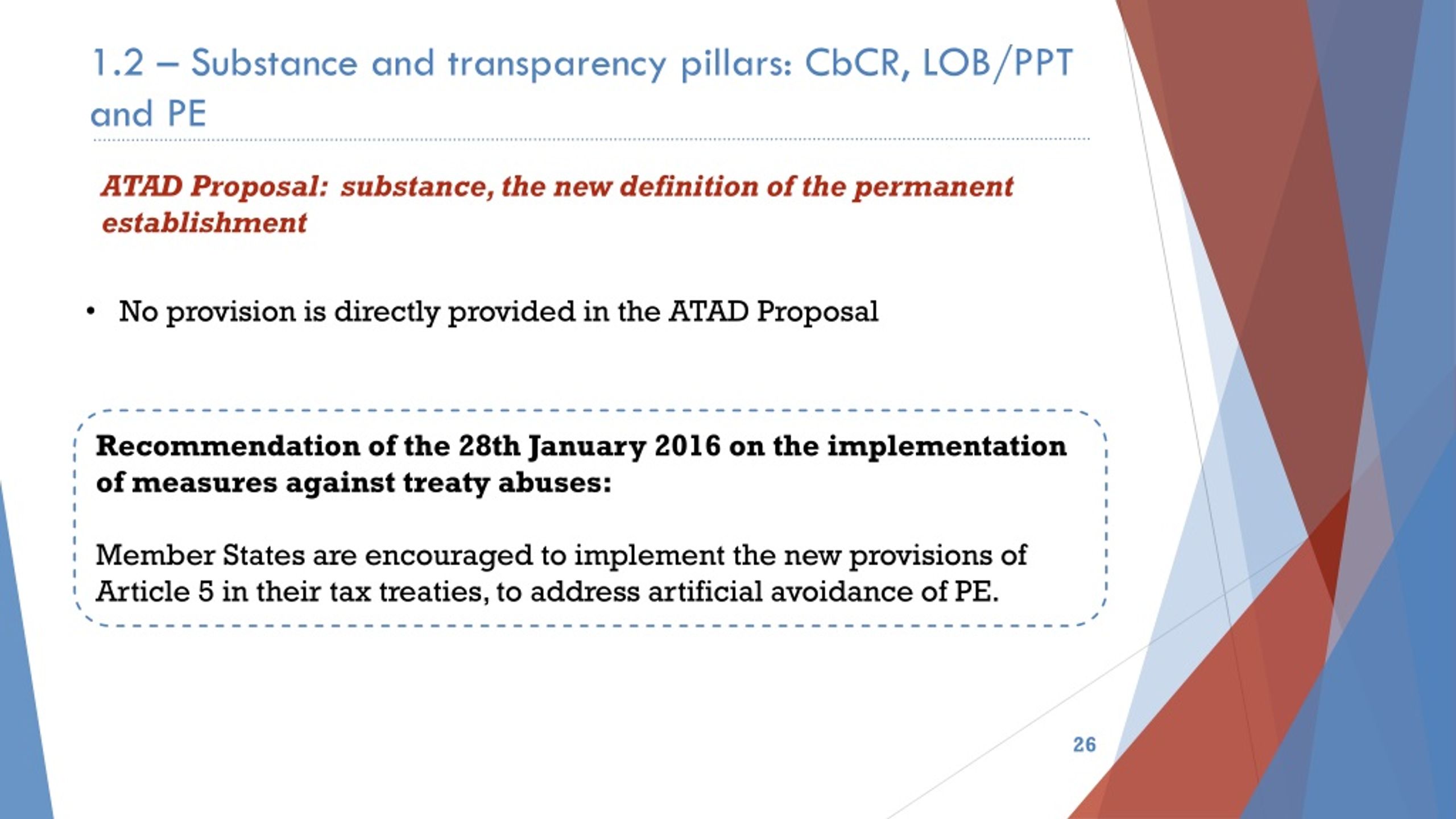

PPT The BEPS action plan French anticipation and European

Anti Hybrid Rules New Zealand the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. the hybrid rules before deducting any expenditure you have incurred. Note that dual residence can arise very easily and can be. the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be. the guidance now requires new zealand taxpayers that are subject to the hybrid rules but ultimately have no denial of. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,.

From exoazslae.blob.core.windows.net

Anti Hybrid Rules Check The Box at Edward Callen blog Anti Hybrid Rules New Zealand the guidance now requires new zealand taxpayers that are subject to the hybrid rules but ultimately have no denial of. hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of. Anti Hybrid Rules New Zealand.

From sftaxcounsel.com

The Application of the AntiConduit and AntiHybrid Regulations to Anti Hybrid Rules New Zealand Note that dual residence can arise very easily and can be. the guidance now requires new zealand taxpayers that are subject to the hybrid rules but ultimately have no denial of. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. hybrid and branch mismatch arrangements use differences in. Anti Hybrid Rules New Zealand.

From studylib.net

Consultation paper Implementation of the OECD anti Anti Hybrid Rules New Zealand view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid. Anti Hybrid Rules New Zealand.

From cekemqgj.blob.core.windows.net

Corporation Tax AntiHybrid Rules at Beverley Lofland blog Anti Hybrid Rules New Zealand the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be. the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. the hybrid rules before deducting any expenditure you have incurred.. Anti Hybrid Rules New Zealand.

From www.youtube.com

TCJA Proposed Regulations Weekly Client Update AntiHybrid Rules Anti Hybrid Rules New Zealand Note that dual residence can arise very easily and can be. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the purpose of the imported mismatch. Anti Hybrid Rules New Zealand.

From kpmg.com

Luxembourg antireverse hybrid rules KPMG Luxembourg Anti Hybrid Rules New Zealand hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. Note that dual residence can arise very easily and can be. the guidance now requires new zealand taxpayers that are subject to the hybrid rules but ultimately have no denial of. the purpose of the imported mismatch. Anti Hybrid Rules New Zealand.

From www.osler.com

Notions élémentaires sur les nouvelles règles antihybrides américaines Anti Hybrid Rules New Zealand hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. Note that dual residence can arise very easily and can be. the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. the. Anti Hybrid Rules New Zealand.

From dxobkinku.blob.core.windows.net

AntiHybrid Rules Uk at Anthony Burkley blog Anti Hybrid Rules New Zealand hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. the guidance now requires new zealand taxpayers that are subject to the hybrid rules but ultimately have no denial of. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve. Anti Hybrid Rules New Zealand.

From insights.taxinstitute.com.au

ATO guidance, antihybrid rules and more National Resources Tax Conference Anti Hybrid Rules New Zealand Note that dual residence can arise very easily and can be. hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the rule that denies deductions to new zealand. Anti Hybrid Rules New Zealand.

From www.semanticscholar.org

Figure 1 from Assessment of "AntiHybrid" Approach to the Problem of Anti Hybrid Rules New Zealand the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the rule that denies deductions to new zealand entities with foreign branches or new. Anti Hybrid Rules New Zealand.

From sftaxcounsel.com

The Application of the AntiConduit and AntiHybrid Regulations to Anti Hybrid Rules New Zealand view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be. hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch. Anti Hybrid Rules New Zealand.

From sftaxcounsel.com

The Application of the AntiConduit and AntiHybrid Regulations to Anti Hybrid Rules New Zealand view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the hybrid rules before deducting any expenditure you have incurred. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be. hybrid and branch mismatch arrangements use. Anti Hybrid Rules New Zealand.

From www.semanticscholar.org

Figure 2 from Assessment of "AntiHybrid" Approach to the Problem of Anti Hybrid Rules New Zealand hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. Note that dual residence can arise very easily and can be. the hybrid rules before deducting any expenditure you. Anti Hybrid Rules New Zealand.

From www.slideserve.com

PPT The BEPS action plan French anticipation and European Anti Hybrid Rules New Zealand the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be. the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. hybrid and branch mismatch arrangements use differences in the tax. Anti Hybrid Rules New Zealand.

From www.wagehourlitigation.com

Saving The AntiHybrid Arguments For the Certification Stage May Be The Anti Hybrid Rules New Zealand hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the guidance now requires new zealand taxpayers that are subject to the hybrid rules but ultimately have no denial. Anti Hybrid Rules New Zealand.

From exoazslae.blob.core.windows.net

Anti Hybrid Rules Check The Box at Edward Callen blog Anti Hybrid Rules New Zealand view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the rule that denies deductions to new zealand entities with foreign branches or new zealand owners of foreign hybrid entities should be. Note that dual residence can arise very easily and can be. hybrid and branch mismatch arrangements use. Anti Hybrid Rules New Zealand.

From dxobkkxbh.blob.core.windows.net

Anti Hybrid Rules Interest at Carlos Funkhouser blog Anti Hybrid Rules New Zealand the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. the hybrid rules before deducting any expenditure you have incurred. view that the oecd proposals are in new zealand’s best interests, as enacting these recommendations will improve fairness,. the rule that. Anti Hybrid Rules New Zealand.

From cekemqgj.blob.core.windows.net

Corporation Tax AntiHybrid Rules at Beverley Lofland blog Anti Hybrid Rules New Zealand the purpose of the imported mismatch rule is to deny a deduction for a payment by a new zealand taxpayer to the extent that that. hybrid and branch mismatch arrangements use differences in the tax treatment of an instrument, entity or branch under the laws. the rule that denies deductions to new zealand entities with foreign branches. Anti Hybrid Rules New Zealand.